south dakota sales tax rate changes 2021

The South Dakota state sales tax rate is currently. 366 rows Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax.

South Dakota Sales Tax Rates By City County 2022

The municipal gross receipts tax can be imposed on alcoholic beverages eating establishments.

. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. For additional information on sales tax please refer to our Sales Tax Guide PDF. The minimum combined 2022 sales tax rate for Delmont South Dakota is.

This is the total of state and county sales tax rates. The County sales tax rate is. The 2018 United States Supreme Court decision in South Dakota v.

Has impacted many state nexus laws and sales tax collection requirements. Over the past year there have been ten local sales tax rate changes in South Dakota. Simplify South Dakota sales tax compliance.

Stacey Anderson Marketing Communications Specialist 605-773-5869 PIERRE SD. The Delmont sales tax rate is. The base state sales tax rate in South Dakota is 45.

To review the rules in South Dakota visit our state-by-state guide. The state sales and use tax rate is 45. The minimum combined 2021 sales tax rate for Turner County South Dakota is.

Beginning July 1 2021 four South Dakota communities will implement a new municipal tax rate. 12-01-2021 1 minute read. The South Dakota sales tax rate is 4 as of 2022 with some cities.

For Immediate Release. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. 2021 state and local sales tax rates.

The 2018 United States Supreme Court. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. Beginning January 1 2022 the town of Lane is implementing a new municipal tax rate from 0 percent general sales and use tax rate to 2 percent.

This is the total of state county and city sales tax rates. Tuesday June 1 2021 Contact. Interactive Tax Map Unlimited Use.

The Lake County sales tax rate is. South Dakota has a higher state sales tax. The following are recent sales tax rate changes in South Dakota.

South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6. The SD use tax only applies to certain purchases. Find your South Dakota combined state and local tax rate.

We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. Ad Lookup Sales Tax Rates For Free. The municipal tax changes taking effect include.

Average Sales Tax With Local. Did South Dakota v. The sales taxes in Hawaii and South Dakota have bases that include many services and so are not strictly comparable to other sales taxes.

The Turner County sales tax rate is. The South Dakota sales tax rate is currently. South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Compare 2021 sales tax rates by state with new resource. They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. Searching for a sales tax rates based on zip codes alone will not work.

There are a total of 289 local tax jurisdictions across the state collecting an average local tax of 1814. Automating sales tax compliance can help your business keep compliant with changing. New rates were last updated on 712021.

South Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales. Look up 2021 sales tax rates for Auance South Dakota and surrounding areas. Click Search for Tax Rate.

Lowest sales tax 45 Highest. Tax rates are provided by Avalara and updated monthly. Old rates were last updated on 712020.

Raised from 45 to 65. Sales and Use Tax Rate Change Effective 112021 https. Raised from 45 to 65.

In addition the town of Henry is amending their municipal tax rate from 1 to 2. For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying. Enter a street address and zip code or street address and city name into the provided spaces.

The South Dakota Department of Revenue administers these taxes. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. Tax rates provided by Avalara are updated monthly.

Look up 2021 sales tax rates for Dixon South Dakota and surrounding areas. Municipalities may impose a general municipal sales tax rate of up to 2. Look up 2021 sales tax rates for Day County South Dakota.

South Dakota municipalities are able to implement new tax rates or change existing tax. What Rates may Municipalities Impose.

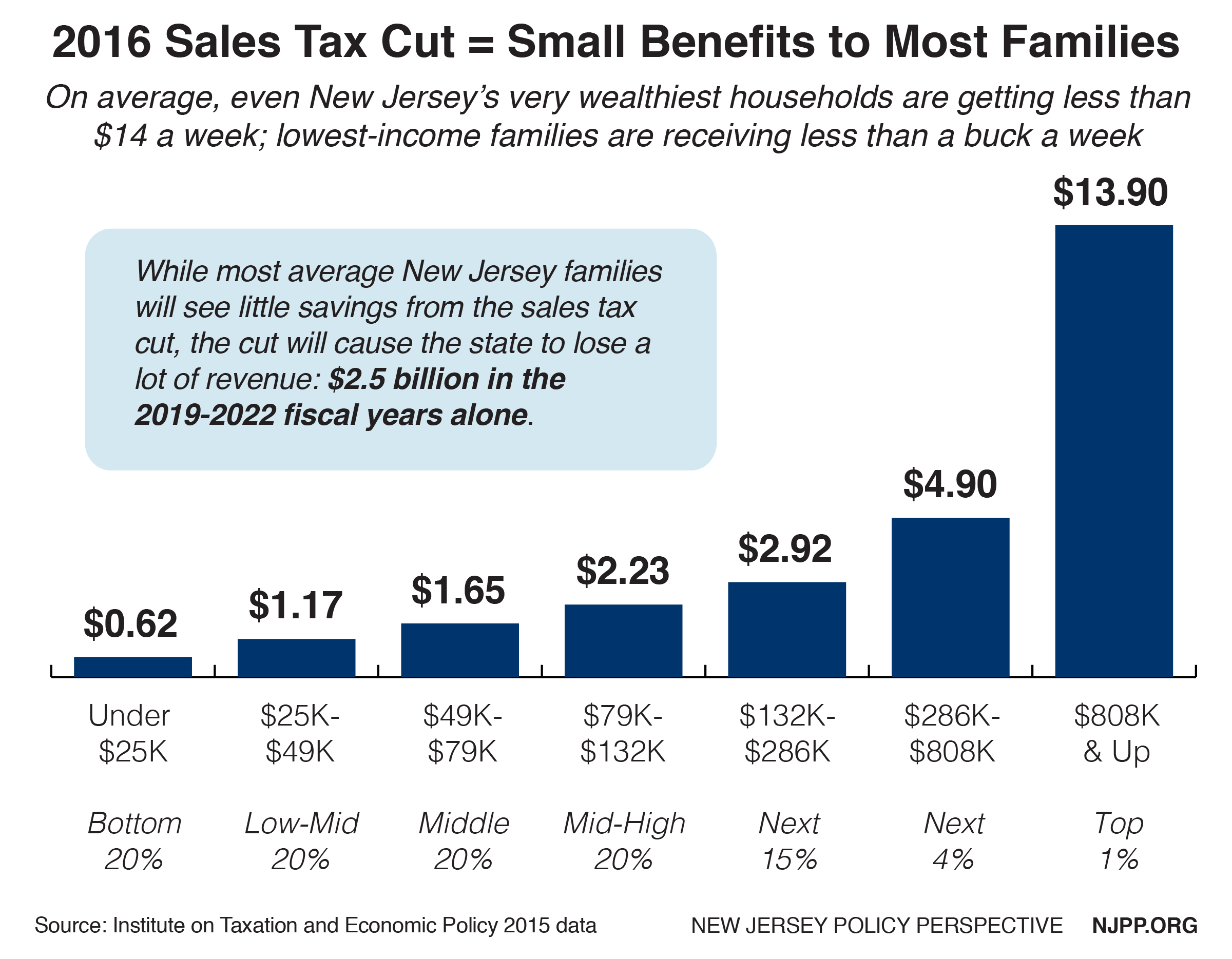

Modernizing New Jersey S Sales Tax Will Level The Playing Field And Help The Economy Thrive New Jersey Policy Perspective

States With Highest And Lowest Sales Tax Rates

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

.png)

States Sales Taxes On Software Tax Foundation

New Municipal Tax Changes Effective January 1 2022 South Dakota Department Of Revenue

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

South Carolina Sales Tax Small Business Guide Truic

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Long Has It Been Since Your State Raised Its Gas Tax Itep

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)