tax refund calculator ontario 2022

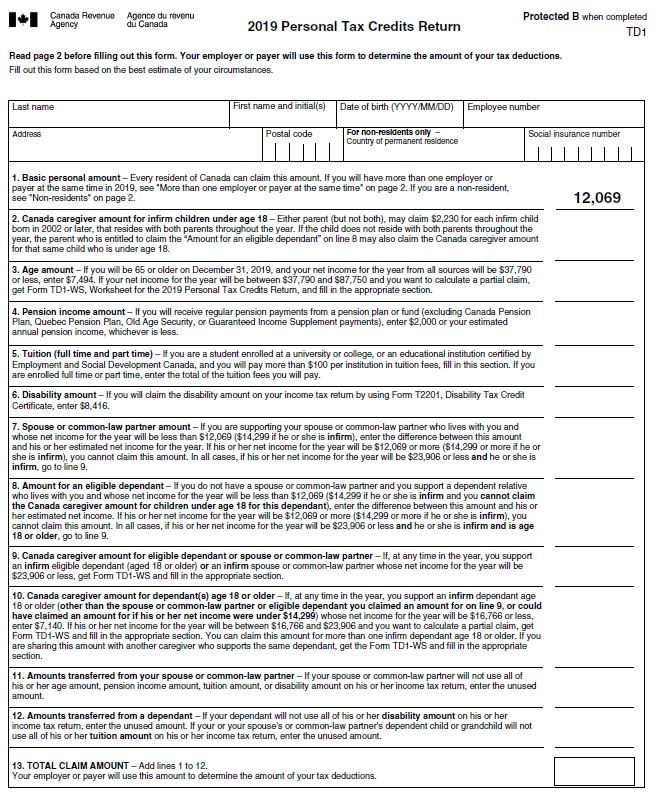

2022 Personal tax calculator. The amount of taxable income that applies to the first tax bracket at 505 is increasing from.

Cerb Tax Calculator Cerb Tax Rate Kalfa Law

Your average tax rate is 270 and your marginal tax rate is 353.

. Calculate your combined federal and provincial tax bill in each province and territory. Ontarios indexing factor for 2021 is 09. Tax Calculator Refund Estimator For 2022 Irs Tax Returns Estimated Results 0000.

The amount of tax your employer deducts from your paycheque varies based on where you fall inside the federal and Ontario tax brackets. Childrens fitness tax credit. The calculator reflects known rates as of June 1 2022.

You can also create your new 2022 W-4 at the end of the tool on the tax return result. However the child will. That means that your net pay will be 37957 per year or 3163 per month.

Your average tax rate is. 476 Provincial or territorial credits attach for 479 if it applies 479 Add lines 437 to 479. This is called the indexing factor.

The 2022 tax year in ontario runs. The following tax data rates and thresholds are used in the 2022 Ontario Tax Calculator if you spot and error or would like additional tax calculations integrated into the 2022 Ontario Tax. Our tax calculator stays up to date with the.

As a result they will increase your Tax Refund or reduce your Taxes Owed. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

Use SmartAssets Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount. That means that your net pay will be 37957 per year or 3163 per. This calculator is updated with rates.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax. X 15 459 Tax paid by instalments. To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability.

Restart Enter the following Tax Payment amounts you made during Tax Year 2021. If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software. The Ontario land transfer tax for a home purchased for 500000 in Ottawa is 6475.

Enter some simple questions about your situation and TaxCaster will estimate your tax refund amount or how much you may owe to the IRS. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits. The Ontario Annual Tax Calculator is updated for the 202223 tax year.

2022 free Canada income tax calculator to quickly estimate your provincial taxes. The maximum tax refund is 4000 as the property is over 368000. Federal income tax rates in 2022 range from 15.

X 15 459 Tax paid by instalments. Loans are offered in amounts of 250 500 750 1250 or 3500. The information deisplayed in the Ontario Tax Brackets for 2022 is used for the 2022 Ontario Tax Calculator.

TurboTax Free customers are entitled to a payment of 999. The calculator reflects known rates as of June 1 2022.

Income Tax Calculator 2021 2022 Estimate Return Refund

2022 Canada Income Tax Calculator Turbotax Canada

Tax Year 2023 January December 2023 Plan Your Taxes

2022 Canada Tax Filing Deadline And What You Need To Know

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

2021 Taxes Everything You Need To Know Ctv News

Taxtips Ca 2021 And 2022 Canadian Income Tax And Rrsp Savings Calculator

What Is Self Employment Tax 2021 22 Rates And Calculator Bench Accounting

Payroll Tax Rates 2022 Guide Forbes Advisor

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

2021 Child Tax Credit Calculator Kiplinger

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Taxes 2022 Important Changes To Know For This Year S Tax Season